The Seven Deadly Sins of Wealth Management: A Path to Financial Ruin

Sloth:

The first deadly sin in wealth management is sloth, or the failure to take appropriate actions towards building and preserving wealth. Many individuals fail to create a comprehensive financial plan, instead choosing to bury their heads in the sand, hoping that their investments will magically grow without effort. This approach can lead to missed opportunities for growth and increased risk due to lack of diversification.

Greed:

Greed, the second sin, is characterized by an excessive desire to acquire more wealth. This often leads investors to take on unnecessary risk in order to achieve higher returns. However, the potential rewards are not always worth the increased risk and volatility, which can ultimately result in significant losses.

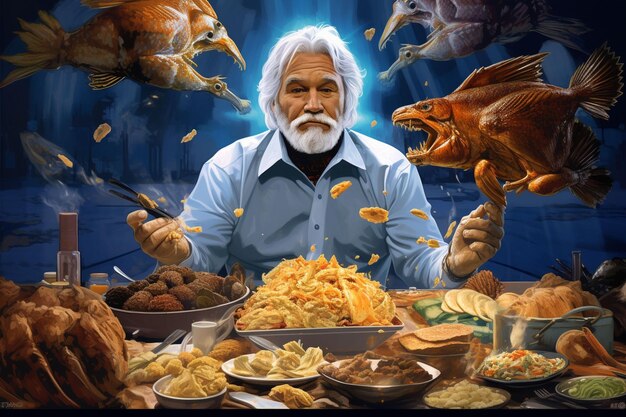

Gluttony:

Gluttony, the third sin, refers to excessive consumption and lack of discipline when it comes to spending. This can lead to a significant drain on one’s resources and can make it difficult to save for the future or meet financial goals. It is important for individuals to live within their means and practice disciplined spending habits.

Lust:

Lust, the fourth sin, can manifest in a number of ways when it comes to wealth management. This may include making investment decisions based on emotions rather than logic and rationality, or allowing personal biases to influence financial choices. It is important for investors to remain objective and avoid making decisions based on fleeting emotions.

Envy:

Envy, the fifth sin, can lead individuals to compare themselves to others and make decisions based on what their neighbors, friends, or colleagues are doing. This can result in unnecessary risk-taking or a failure to take appropriate actions towards reaching financial goals due to a fear of falling behind. It is important for individuals to focus on their own financial situation and goals, rather than comparing themselves to others.

Pride:

Pride, the sixth sin, can lead investors to overestimate their own abilities and take on more risk than they are comfortable with. This can result in significant losses and financial hardship. It is important for individuals to recognize their limitations and seek the help of professionals when necessary.

Wrath:

Wrath, the seventh and final sin, can lead to impulsive actions and decisions that can have negative consequences for one’s financial situation. This may include reacting emotionally to market volatility or making hasty decisions based on anger or frustration. It is important for investors to remain calm and patient, even in difficult market conditions, and avoid making impulsive decisions that can lead to long-term damage.

I. Introduction

Wealth management plays a crucial role in one’s

financial well-being

. It goes beyond just accumulating wealth; it involves preserving, protecting, and growing assets through various investment strategies and financial planning techniques. Ethical principles are an essential component of effective

wealth management

. They not only help individuals make informed decisions that align with their values but also build trust and long-term relationships with financial advisors.

Explanation of the importance of wealth management in financial well-being

Wealth management is more than just managing investments; it’s about ensuring a secure financial future. It involves creating and implementing strategies to meet both short-term and long-term financial goals, such as retirement planning, education funding, or estate preservation. By working with a professional advisor, individuals can benefit from expert advice on investment strategies, tax planning, and risk management.

The role of ethical principles in effective wealth management

Ethical principles are essential in wealth management for several reasons. They help maintain trust between clients and advisors, ensuring that financial advice is given with the client’s best interests at heart. Ethical principles also help individuals make decisions that align with their values and long-term goals, avoiding potential conflicts of interest or unethical practices.

Introduce the concept of “The Seven Deadly Sins of Wealth Management”

To better understand the common pitfalls and ethical dilemmas in wealth management, let’s explore the metaphorical framework of “The Seven Deadly Sins of Wealth Management.” These sins represent various ethical challenges that individuals and financial advisors may face during the wealth management process.

Greed: Excessive Focus on Short-Term Profits

Definition of Greed and Its Impact on Wealth Management:

Greed (an excessive desire to possess more than one needs or deserves, especially with respect to material wealth) is a destructive force in the world of wealth management. It leads individuals and institutions to disregard long-term planning and future financial needs in favor of immediate gains. Greed often clouds judgment, causing investors to neglect essential strategies such as diversification and risk management.

Disregard for Long-Term Planning and Future Financial Needs:

The focus on short-term profits can lead investors to overlook the importance of preparing for future financial needs. They may fail to save adequately for retirement, education, or emergencies in favor of chasing quick gains. This shortsighted approach can result in significant financial hardship later on.

Neglecting Diversification and Risk Management Strategies:

An excessive focus on short-term profits can also lead investors to neglect crucial strategies like diversification and risk management. They might pile all their resources into a single investment, hoping for a quick payday. However, this approach leaves them vulnerable to market fluctuations and volatility. One misstep can result in substantial losses that could have been mitigated with a well-diversified portfolio and effective risk management strategies.

Consequences of Excessive Focus on Short-Term Profits:

Missed Opportunities for Long-Term Growth:

By fixating on immediate gains, investors may miss out on opportunities for significant long-term growth. They might overlook promising investments with solid fundamentals but require a longer time horizon to yield substantial returns. In the end, their portfolios may underperform due to their myopia and failure to consider the potential benefits of patience and a long-term perspective.

Increased Vulnerability to Market Fluctuations and Volatility:

An excessive focus on short-term profits increases an investor’s vulnerability to market fluctuations and volatility. As mentioned earlier, investors who neglect diversification and risk management strategies expose themselves to substantial losses if the market takes a downturn. Moreover, their fixation on quick gains can lead them to make hasty decisions based on short-term market movements, further increasing the chances of incurring losses.

I Sloth: in the context of wealth management, refers to the lack of financial literacy and planning.

Definition:

This state of being slothful towards managing one’s finances can be broken down into two key components:

Failure to Understand Financial Concepts and Markets:

Slothful individuals often lack a fundamental grasp of financial concepts, such as interest rates, inflation, budgeting, or investment strategies. This can lead to an inability to make informed decisions about their money, and a reliance on others to manage their finances for them.

Neglecting to Create a Comprehensive Financial Plan:

Slothful individuals may also fail to create a well-thought-out financial plan, instead relying on haphazard savings or sporadic investments. This lack of planning can result in missed opportunities for growth and potentially leave them vulnerable to financial shocks.

Consequences:

The consequences of sloth in wealth management can be severe:

Lack of Progress towards Financial Goals:

Those who do not take an active role in their finances may find themselves making little to no progress towards achieving their financial goals. This can include everything from saving for retirement, paying off debt, or even purchasing a home.

Increased Susceptibility to Financial Hardships and Unexpected Expenses:

Slothful individuals are often more susceptible to financial hardships, such as unexpected expenses or economic downturns. Without a solid financial plan and a strong understanding of their finances, they may struggle to recover from these setbacks.

Ethical Implications:

The ethical implications of sloth in wealth management are significant. As financial professionals, it is our responsibility to encourage education, awareness, and empowerment among our clients. By failing to do so, we risk perpetuating a cycle of financial ignorance and hardship. Instead, we should be working to equip our clients with the knowledge and tools they need to take an active role in their wealth management.

Envy: Comparison and Jealousy in Wealth Management

Definition of Envy and Its Impact on Wealth Management

Envy, a complex emotion, arises when we compare ourselves unfavorably to others and feel that they have something we desire, particularly in the realm of financial success. Unfortunately, this preoccupation with others’ wealth can hinder our own progress in wealth management.

Focusing on Others’ Financial Success Rather Than One’s Own Progress

Envy can lead us to spend more time and energy focusing on what others have, rather than our own financial goals and progress. This unproductive comparison can result in feelings of dissatisfaction and frustration, which may negatively impact our motivation to save, invest, and manage our finances effectively.

Consequences of Envy

The consequences of envy can be far-reaching and detrimental to our personal well-being and financial stability.

Emotional Distress and Stress on Personal Relationships

Envy can cause significant emotional distress and, in some cases, put pressure on personal relationships. Feelings of jealousy and comparison may lead to resentment or even hostility towards those who seem financially more successful.

Impaired Decision-Making and Potential for Risky Investments

Envy can also cloud our judgment when it comes to financial decision-making. We may feel compelled to make risky investments or take on excessive debt in an attempt to “keep up” with others, potentially leading to financial instability.

Ethical Implications

Envy’s negative impact on wealth management highlights the importance of focusing on our individual goals, progress, and understanding that everyone’s financial journey is unique. Encouraging a mindset that values personal growth and self-improvement over comparison to others can lead to more productive, fulfilling financial lives.

Pride: Overconfidence in Knowledge or Abilities

Definition of Pride and Its Impact on Wealth Management

Pride is a feeling of deep pleasure or satisfaction derived from one’s own achievements, qualities, or possessions. In the context of wealth management, pride often manifests as a belief in possessing superior financial knowledge or skills. This can lead individuals to disregard professional advice and expert opinions, relying solely on their own assessments and decisions.

Belief in Possessing Superior Financial Knowledge or Skills

Many people believe they have a better understanding of the financial markets than they actually do. This overconfidence can lead to risky investments, misunderstanding of financial instruments, and poor decision-making. Pride can also make individuals resistant to learning new things or seeking out professional guidance.

Disregard for Professional Advice and Expert Opinions

When individuals are overly confident in their financial knowledge, they may disregard the advice of professionals. This can result in missed opportunities or potential losses. For example, an individual who believes they know better than their financial advisor may ignore their recommendations and make investments that are not aligned with their personal financial goals or objectives.

Consequences of Pride

Misalignment with Personal Financial Goals and Objectives

Overconfidence in one’s financial knowledge can lead to investments that are not aligned with personal financial goals and objectives. This misalignment can result in missed opportunities for growth, increased risk exposure, and potential losses.

Increased Vulnerability to Market Risk and Potential for Significant Losses

Pride can make individuals more vulnerable to market risk. When individuals are overconfident in their abilities, they may take on more risk than they can handle. This can result in significant losses, especially during market downturns or economic instability.

Ethical Implications

Encouraging humility, openness to learning from others, and seeking professional guidance when necessary are important ethical considerations in wealth management. By acknowledging the limitations of one’s own knowledge and expertise, individuals can make more informed decisions and avoid the pitfalls of overconfidence.

VI. Wrath:: Emotional Reactions to Market Volatility and Economic Events

Definition of Wrath

Wrath, a fierce or violent emotion caused by frustration or anger, can significantly impact wealth management. In the context of finance, wrath refers to the negative emotional response to market fluctuations and economic events. These reactions can range from anxiety and fear to anger and despair, leading individuals to make hasty decisions that may not align with their long-term financial goals.

Impact on Wealth Management

Negative Emotional Response:

The wrathful response to market volatility and economic events can be detrimental to one’s financial wellbeing. The fear of losing money often drives individuals to make impulsive decisions that may not be based on sound judgment.

Making Hasty Decisions:

In the heat of the moment, individuals may sell their stocks or investments at a significant loss, only to regret their decision later. This reaction can result in substantial financial losses and hinder the progress towards achieving long-term financial objectives.

Impaired Decision-Making:

The emotional turmoil caused by wrath can cloud one’s judgment, leading to impaired decision-making abilities. In the long term, this can negatively impact an individual’s financial portfolio and overall financial stability.

Consequences of Wrath

Significant Financial Losses:

Impulsive decisions driven by wrath can lead to significant financial losses. Selling stocks at a loss during a market downturn, for example, may result in missing out on potential future gains when the market recovers.

Negative Impact on Long-Term Financial Goals:

A wrathful response to market volatility and economic events can negatively impact an individual’s long-term financial goals. Emotional reactions often lead to short-term thinking, which can hinder the progress towards achieving long-term objectives.

Ethical Implications

Encouraging a Calm, Rational Approach:

It is essential for individuals to understand the potential consequences of wrath in wealth management. Encouraging a calm, rational approach to managing financial affairs can help minimize the influence of emotions on investment choices and lead to better long-term outcomes.

Minimizing Influence of Emotions:

Adopting a disciplined, emotion-driven approach to managing finances can help individuals make informed decisions based on sound judgment rather than emotional reactions. This can lead to improved financial stability and the achievement of long-term objectives.

V Lust: Excessive Consumption and Debt

Definition of lust and its impact on wealth management

Lust, defined as an intense desire or craving for something, particularly material possessions, can significantly impact one’s wealth management practices. It often leads to a disregard for the importance of saving and living below means, as individuals prioritize instant gratification over long-term financial security. The excessive focus on material possessions and immediate satisfaction can result in overspending and debt accumulation, which ultimately limits financial resources for crucial long-term goals and future needs.

Consequences of lust:

Limited financial resources for long-term goals and future needs

The obsession with instant gratification through excessive consumption can result in insufficient funds available for important financial objectives such as retirement savings, children’s education, or emergency funds.

Debt accumulation and potential insolvency

The inability to control spending driven by lust often leads to mounting debts, which can lead to financial instability and even insolvency if not managed responsibly.

Ethical implications:

Encouraging a balanced approach to consumption, saving, and debt management is crucial in navigating the complex relationship between lust and wealth management. Consumers should consider both their short-term wants and long-term financial objectives, making informed decisions that promote financial stability and growth without compromising ethical standards.

| Short-term wants | Long-term financial objectives | |

|---|---|---|

| Consumption | New car, fancy gadgets | Retirement savings, emergency funds |

| Saving | Low | High |

| Debt management | Ignored or maxed out credit cards | Manageable debts, financial stability |

VI Gluttony: This deadly sin not only affects our physical health but also has significant implications for wealth management.

Definition of Gluttony and Its Impact on Wealth Management:

Gluttony is defined as an inordinate desire to consume more than that which is necessary or reasonable. In the context of wealth management, gluttony translates into wasting financial resources on unnecessary expenses. Instead of optimizing income and investments, individuals who succumb to gluttony may prioritize immediate gratification over long-term financial security.

Consequences of Gluttony:

The consequences of gluttony can be far-reaching and severe. By failing to manage financial resources efficiently, individuals may find themselves with limited financial resources for achieving long-term goals, such as retirement or education. Furthermore, the inefficient management of finances can lead to significant losses due to high-interest debt or poor investment decisions.

Ethical Implications:

From an ethical standpoint, the sin of gluttony underscores the importance of efficient and effective use of financial resources. While it is essential to maintain a reasonable standard of living, it is equally important to focus on long-term goals. By being mindful of our spending habits and prioritizing savings and investments, we can minimize the impact of gluttony and ensure a more secure financial future.

IX. Conclusion: The Importance of Ethical Principles in Wealth Management

In the complex and dynamic world of wealth management, it is crucial to be aware of the potential pitfalls that can derail even the most well-intentioned financial strategies. Greed, one of the seven deadly sins, can lead investors to make hasty and uninformed decisions based on short-term gains rather than long-term value. Envy, can fuel a desire to keep up with the Joneses and result in unnecessary debt and financial instability. Lust, can lead to impulsive spending on non-essential items, while Sloth, can result in a lack of financial planning and preparation. Pride, can cause individuals to underestimate risk and overlook important information, while Wrath, can lead to emotional responses that negatively impact financial decisions. Lastly, Gluttony, can result in excessive spending and a lack of discipline in managing personal finances.

Emphasis on the Importance of Ethical Principles

The consequences of these sins can be severe and far-reaching. They can lead to financial instability, ruined relationships with advisors and family members, and even legal action. It is therefore essential to emphasize the importance of ethical principles in wealth management. Ethics provide a solid foundation for successful financial strategies. Principles such as honesty, integrity, and fiduciary responsibility are essential in building trust with clients and advisors alike. Honesty ensures that all information is accurate and complete, while integrity maintains a commitment to acting in the best interests of the client. Fiduciary responsibility mandates putting clients’ needs above one’s own, fostering a strong and lasting relationship built on trust.

Encouragement of Ongoing Education, Self-Reflection, and Professional Guidance

Mitigating the risks associated with the seven deadly sins requires ongoing education, self-reflection, and professional guidance. Ongoing education is crucial in staying informed about the latest financial trends and regulatory changes. It also allows individuals to expand their knowledge and skills, enabling them to make more informed decisions. Self-reflection is essential in identifying personal biases, habits, and tendencies that might negatively impact financial decision-making. Regular self-evaluation can help individuals stay on track towards their long-term financial goals. Professional guidance is invaluable for those seeking to navigate the complexities of wealth management effectively and ethically. Working with a trusted financial advisor can provide an objective perspective, expert knowledge, and valuable insights into managing personal finances.